Candle Making Business Plan Template [Updated 2024]

Candle Making Home Business Plan Template

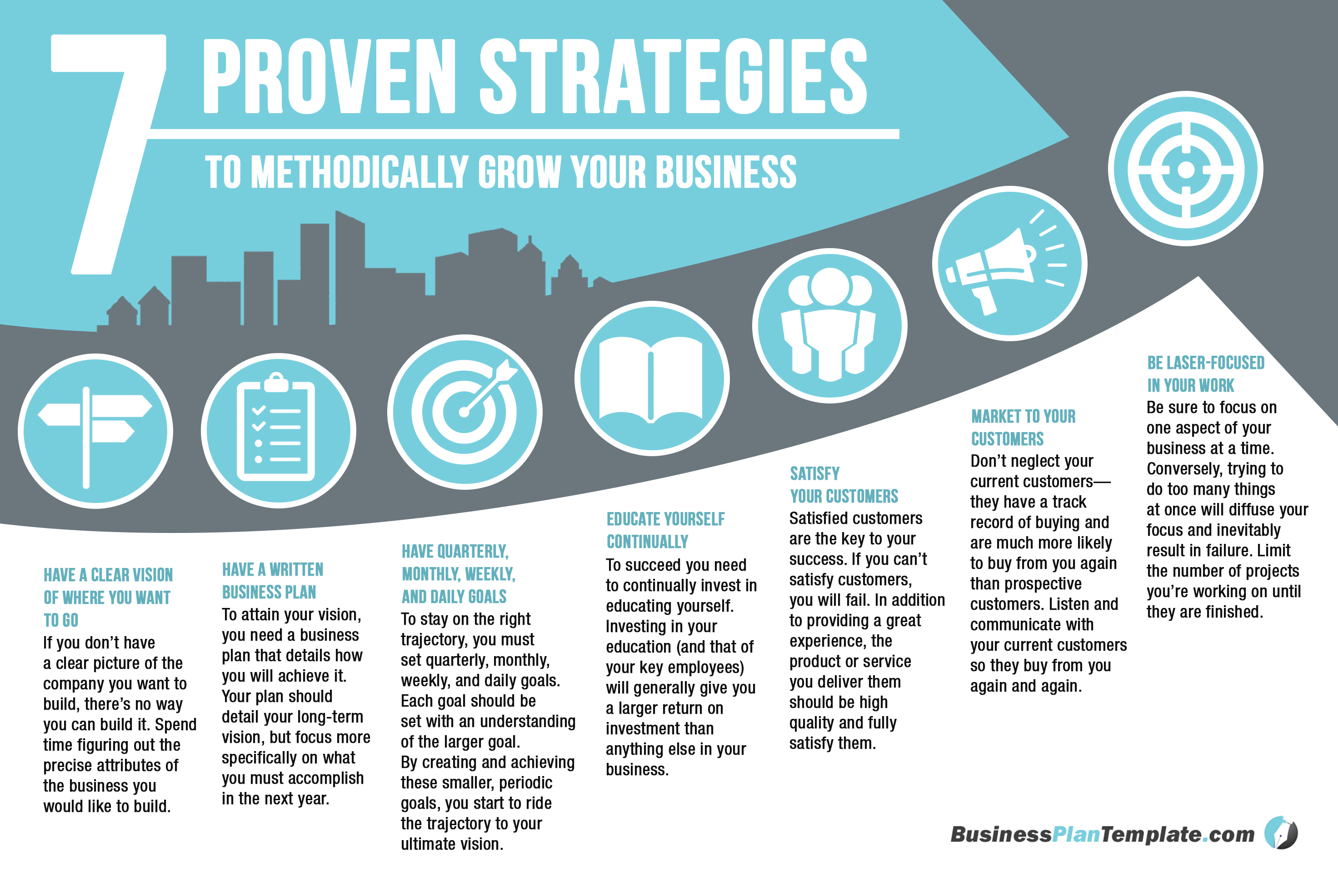

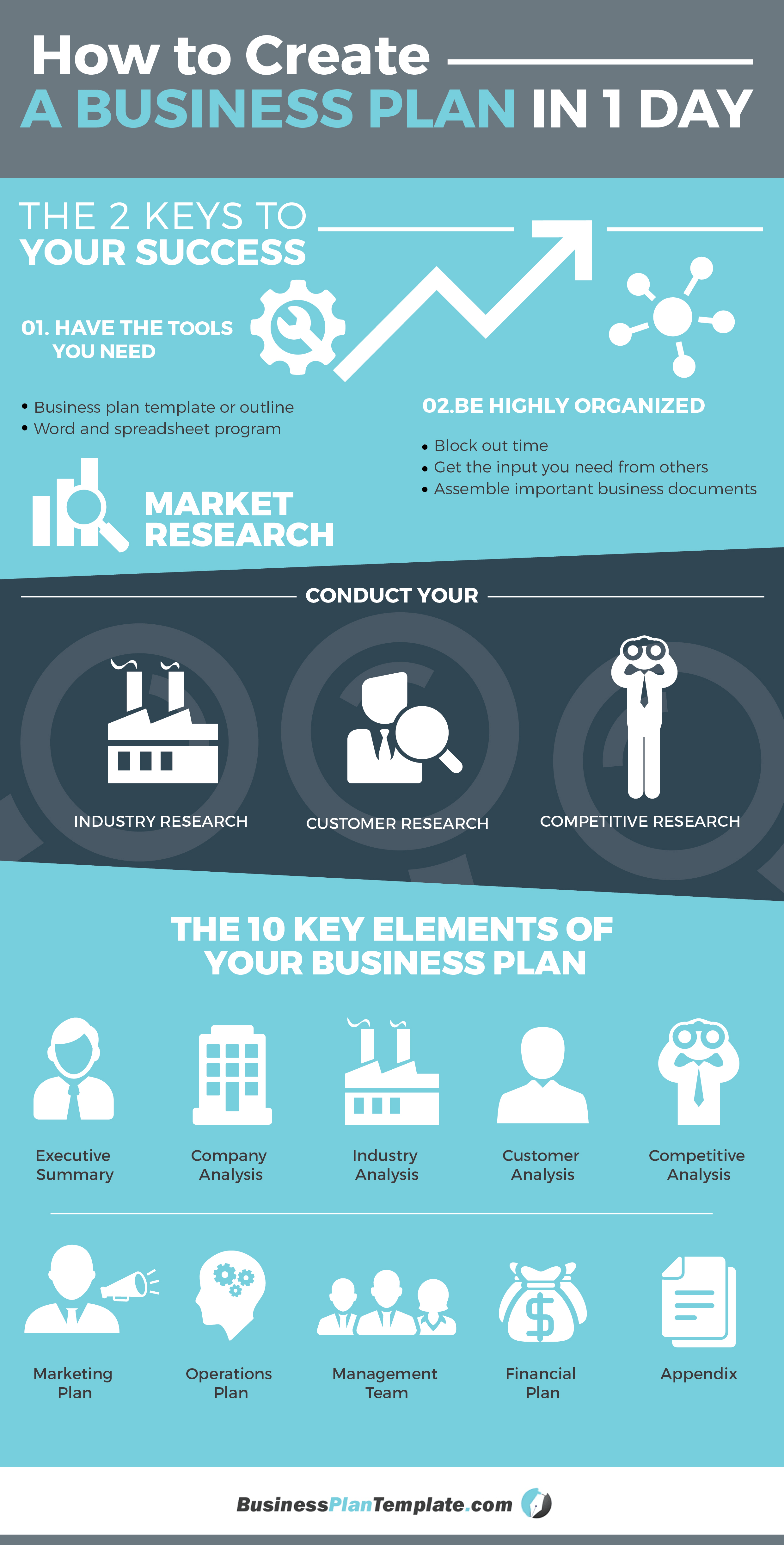

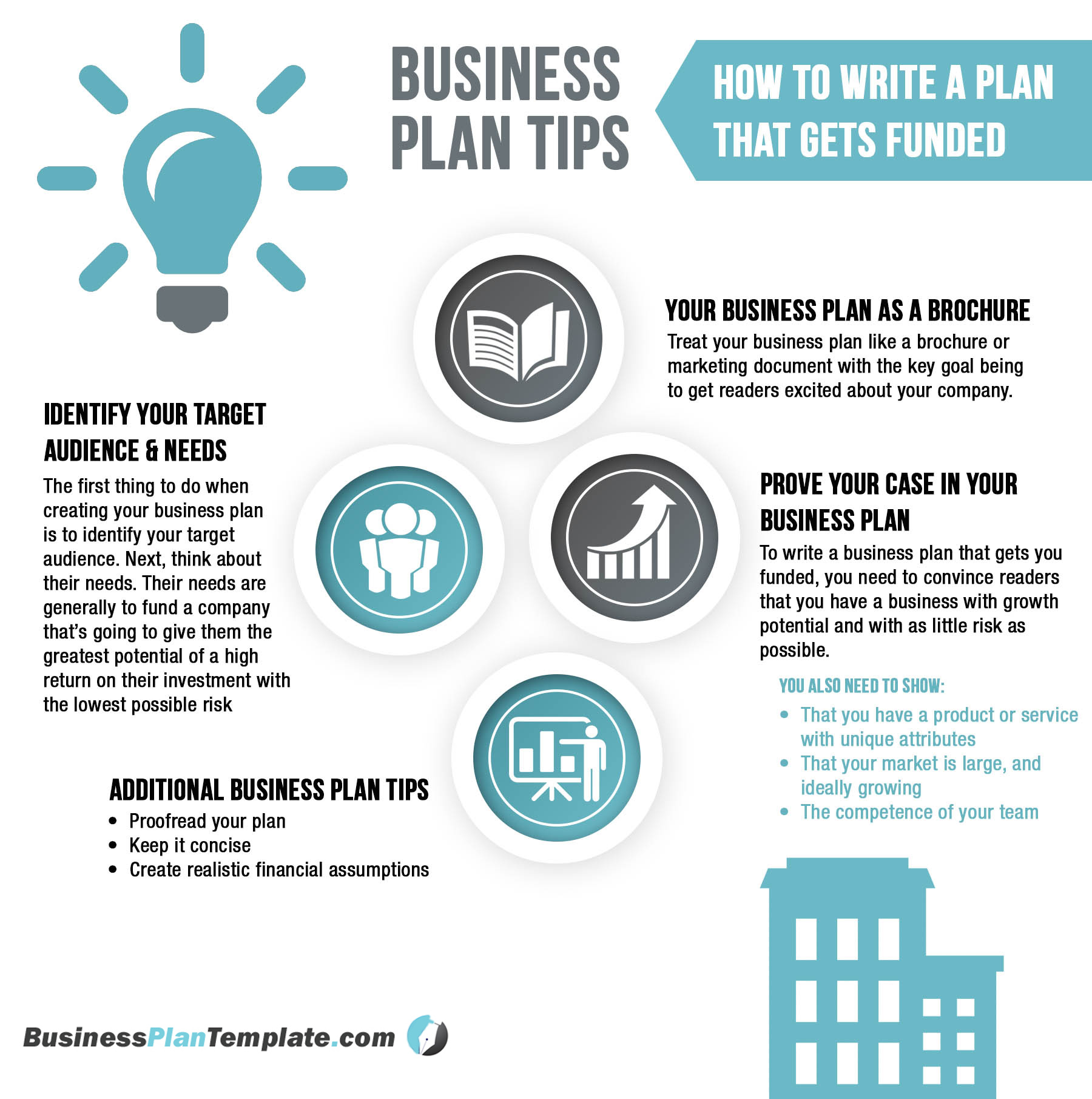

If you want to start a Candle Making business or expand your current Candle business, you need a business plan.

Fortunately, you’re in the right place. Our team has helped develop over 100,000 business plans over the past 20 years, including thousands of candle making business plans.

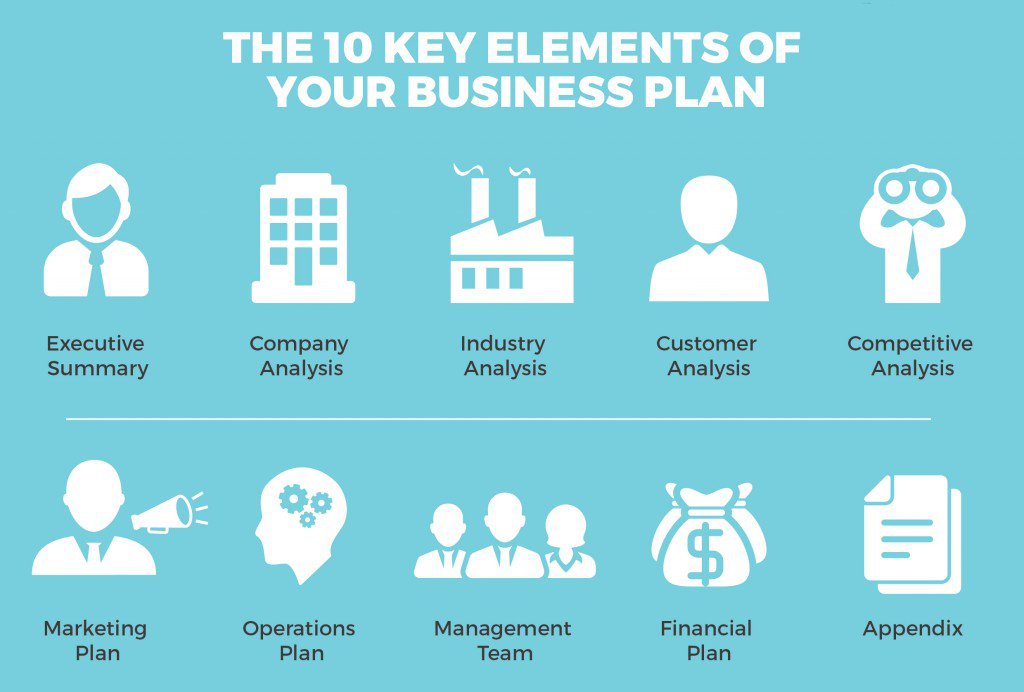

The following candle making business plan template and example gives you the key elements you must include in your plan. In our experience speaking with lenders and investors, the template is organized in the precise format they want.

Candle Business Plan Example

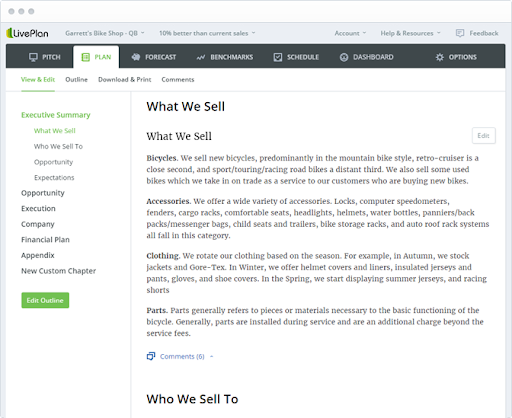

I. Executive Summary

Business Overview

[Company Name], located in [insert location here], is a well-known candle manufacturing company that makes eco-friendly organic candles made with high quality ingredients. The Company carefully curates its collection and only chooses sophisticated scents. The Company distributes its products nationwide to major retailers and select department stores. The Company’s products are also available directly to consumers via their website and a local brick and mortar location. The Company’s goal is to become one of the leading candle manufacturing companies in the area.

Products Served

[Company Name] manufactures and sells unscented and scented candles. It will offer the following products to its customers:

- A variety of everyday candles such as tapers, votives, pillars and floating candles

- Soy Candles

- Novelty Candles

- Unscented Candles

- Signature Scented Candles

Customer Focus

[Company Name] will primarily offer its products direct to consumers, as well as select retailers and spas. The demographics of the market are:

- Individual Buyers: 57%

- Spas: 23%

- Retail Locations: 20%

Management Team

[Company Name] is led by [Founder’s name], who has been in the candle manufacturing business for [x] years. [Founder’s name] is a seasoned entrepreneur with a degree in Chemistry and a Master’s Degree in Business Management. During his internship at [insert company], he acquired in-depth skills in candle making & designing. Additionally, he worked for large and reputable organizations in the course of his career, learning how to manage and run a candle making business before starting [Company name].

Success Factors

[Company Name] is qualified to succeed due to the following reasons:

- There is currently a high demand for candles in the U.S.

- In addition, the company surveyed the population and received highly positive feedback pointing towards an explicit demand for their products, supporting the business after launch.

- The management team has a track record of success in the candle making business.

- The candle business is a proven, successful business in the United States.

Financial Highlights

[Company Name] is currently seeking $270,000 to launch its candle making company. Specifically, these funds will be used as follows:

- Manufacturing equipment and facility setup: $200,000

- Working capital: $70,000 to pay for marketing, salaries, and lease costs until [Company Name] reaches break-even

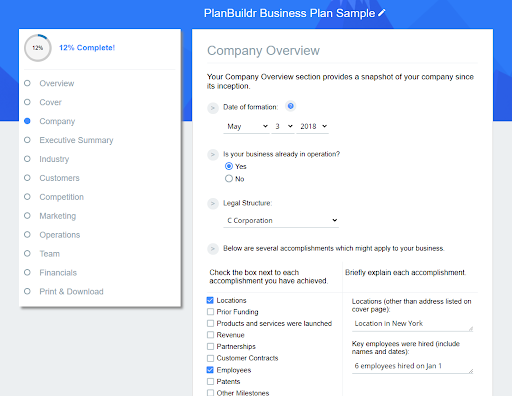

II. Company Overview

Who is [Company Name]?

[Company Name], located in [insert location here], is a well-known candle manufacturing company that makes eco-friendly organic candles made with high quality ingredients. The Company carefully curates its collection and only chooses sophisticated scents. The Company distributes its products nationwide to major retailers and select department stores. The Company’s products are also available directly to consumers via their website and a local brick and mortar location. The Company’s goal is to become one of the leading candle manufacturing companies in the area.

[Company Name]’s History

[Founder’s Name] is an entrepreneur with a passion for candle designing who seeks to create a legacy that will make the company stand out uniquely from its competitors. [Company Name] will become a known candle manufacturer in [Location], offering a wide selection of candles.

Upon surveying the local customer base and finding the potential retail location, [Founder’s Name] incorporated [Company Name] as an S-Corporation on [date of incorporation].

[Founder’s Name] has selected an initial location and is currently undergoing due diligence on each property and the local market to assess the most desirable location for the manufacturing facility.

Since incorporation, the company has achieved the following milestones:

- Found retail space and signed Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Determined raw material requirements

- Began recruiting key employees with experience in the candle making industry

[Company Name]’s Products/Services

[Company Name] manufactures and sells unscented and scented candles. It will offer the following products to its customers:

- A variety of everyday candles such as tapers, votives, pillars and floating candles

- Soy Candles

- Novelty Candles

- Unscented Candles

- Signature Scented Candles

III. Industry Analysis

[Company Name] competes against small, individually owned candle-making companies and major regional or national chains. The candle market size was valued at $7.3 million last year is projected to reach $10.7 million in the next five years, growing at a CAGR of 5.26%. The growth of the market is being driven by an increase in the number of hotels, restaurants, wellness facilities, as well as the number of household candle purchases. Increased home renovation and home décor activities have driven the demand for scented candles in the residential sector.

IV. Customer Analysis

Demographic Profile of Target Market

[Company Name] will primarily offer its products direct to consumers, as well as select retailers and spas. The demographics of the market are:

There are 1.5 million retail and wholesale businesses in the U.S.

The precise demographics of individuals living in the U.S. are as follows:

| United States | |

|---|---|

| Total Population | 312,796,426 |

| Population Male | 49.00% |

| Population Female | 51.00% |

| Median Age | 37.5 |

| Target Population by Age | |

| Age 18 to 24 | 9.99% |

| Age 25 to 34 | 13.08% |

| Age 35 to 44 | 12.94% |

| Age 45 to 54 | 14.64% |

| Age 55 to 64 | 12.43% |

| Median Household Income | $57,639 |

| Households w/disposable income | |

| Income $50,000 to $74,999 | 18.03% |

| Income $75,000 to $99,999 | 12.97% |

| Income $100,000 to $124,999 | 8.65% |

| Income $125,000 to $149,999 | 5.40% |

| Income $150,000 to $199,999 | 5.12% |

| Income $200,000 and Over | 5.34% |

Customer Segmentation

The Company will primarily target the following customer segments:

- Individual Buyers: Individual consumers, especially households will be key targets for the company. Scented candles will be a leading product for the households.

- Spas: The second target group comprises spas. As candles have therapeutic properties, commercial businesses like spas frequently use scented candles. The Company will offer its products, at a wholesale rate to this segment.

- Retail Locations: Other retail locations such as specialty shops, home décor stores and mass merchandisers such as department stores and drug store chains will also be a valuable customer segment for the Company.

V. Competitive Analysis

Direct & Indirect Competitors

Wax Shop

Wax Shop is one of the popular candle shops in town and has been in business for xx years. Wax Shop offers a wide array of products that one would expect from a candle shop- scented candles, votives, tapers, jar candles and more. Besides offering candles, Wax Shop offers other products including reed diffusers, linen spray, room spray, wax melts, and pure-fragrance oil.

Home Fragrance Inc

Home Fragrance Inc is a manufacturer of quality candles and industrial waxes. Candles ranging from pressed tealights to custom votives and scented pillar candles to private-label filled candles, Home Fragrance Inc’s flexible production facility allows it to meet unique manufacturing demands with a quick turn-around time without compromising quality. Waxes ranging from paraffin to natural and custom wax blends to wax additives. The company is a 5th generation family-owned and run facility, based in the [location] uses high-grade raw materials and tests every production batch to provide consistent and uniform products – ranging from industrial to luxury. Home Fragrance Inc, on the other hand, does not sell its products through retail stores.

Candle Coop

Candle Coop was established in [xx]. It has a solid reputation for treating its clients right. Candle Coop’s differentiating factor is proprietary soy wax formula. This unique blend of wax offers a natural and environmentally friendly solution to fragrance the home. The exclusive odor eliminating formula it uses seeks and eliminates odor molecules, rather than masking the smell. Candle Coop’s Pure Air Odor Eliminating candles work on almost any type of odor; pet, garbage, cooking, basement, bathroom.

Competitive Advantage

[Company Name] enjoys several advantages over its competitors. These advantages include:

- Management: The Company’s management team has xx years of business and marketing experience that allows them to market and serve customers in an improved and sophisticated manner than the competitors.

- Relationships: Having lived in the community for xx years, [Founder’s Name] knows all of the local leaders, newspapers, and other influencers. As such, it will be relatively easy for [Company Name] to build brand awareness and an initial customer base.

- Great service at an affordable price: The wide range of products and services offered by [Company Name] nearly equals the most premium positioned competitor, [Competitor Name]. However, [Company Name] will offer candles at a much more affordable price.

VI. Marketing Plan

The [Company Name] Brand

[Company name] seeks to position itself as an upper-middle-market competitor in the candle making industry. Customers can expect to receive beautifully-designed candles from skilled artisans for a price somewhere between discount chains and luxury establishments.

The [Company Name] brand will focus on the company’s unique value proposition:

- Offering a wide collection of candles for different occasions and settings

- High quality, eco-friendly ingredients

- Moderate price point

- Well-trained staff that prioritizes customer satisfaction

- Thorough knowledge of the industry

Promotions Strategy

[Company Name] expects its target market to be individual buyers, retail locations and spas throughout the US. The Company’s promotional strategy to reach the audience includes:

Pre-Opening Events

Prior to launching the business, [Company Name] will organize pre-opening events designed for prospective customers, local merchants, and press contacts. These events will create buzz and awareness for [Company Name] in the area.

Public Relations

[Company Name] will hire an experienced PR agency/professional(s) to formulate a compelling PR campaign to boost its brand visibility among the target audience. It will look to garner stories about the company and its offerings in various media outlets like newspapers, podcasts, television stations, radio shows, etc.

Social Media Marketing

Social media is one of the most cost-effective and practical marketing methods for improving brand visibility. The Company will use social media to develop engaging content in terms of different candle designs and customer reviews that will increase audience awareness and loyalty. Engaging with prospective clients and business partners on social media platforms like Facebook, Instagram, Twitter, and LinkedIn will also help understand changing customer needs.

Word of Mouth Marketing

[Company name] will encourage word-of-mouth marketing from loyal and satisfied clients. The Company will use recommendations and word-of-mouth marketing to grow the customer base through the network of its existing customers. The Company will be incentivizing its existing customer base to encourage their friends to come and try their product for the first time.

Special Offers

The Company will introduce special offers to attract new consumers and encourage repeat purchases, which will be quite advantageous in the long run.

Pricing Strategy

[Company Name]’s pricing will be moderate, so customers feel they receive great value when availing of the products they are paying for. The customer can expect to receive high-quality candles for a more affordable price than what they pay to ultra-premium brands.

VII. Operations Plan

Functional Roles

[Founder’s Name] will run the day-to-day operations of the candle manufacturing plant, including scheduling, sourcing and purchasing supplies and basic equipment, keeping the company’s books, maintaining legal licenses, handling insurance, and ensuring that the company meets government regulations.

To execute on [Company Name]’s business model, the company needs to perform several functions, including the following:

Administrative & Service Functions

- General & administrative functions including legal, marketing, bookkeeping, etc.

- Inventory management

- Hiring and training staff

- Candle Making and Packaging

- Maintenance personnel

Milestones

[Company Name] expects to achieve the following milestones in the following [] months:

| Date | Milestone |

|---|---|

| [Date 1] | Finalize lease agreement |

| [Date 2] | Design and build out [Company Name] |

| [Date 3] | Hire and train initial staff |

| [Date 4] | Kickoff of promotional campaign |

| [Date 5] | Launch [Company Name] |

| [Date 6] | Reach break-even |

VIII. Management Team

Management Team Members

[Company Name]’s most valuable asset is the expertise and experience of its founder, [Founder’s Name]. [Founder’s Name] has been working in the candle manufacturing business for many years. [Founder’s name] is a seasoned artisan with a degree in Chemistry and holds a Master’s Degree in Business Management. He has immense interest in new candle making techniques, and also has the capital needed to start the business. [Founder] also has personal relationships with highly skilled chandlers in the candle making industry.

Hiring Plan

[Founder] will serve as the CEO. In order to establish candle making business and retail stores, the company will need to hire the following personnel:

- Candle Makers [Number]

- Product Development Manager

- Sales and Marketing Manager

- Store Manager

- Accountant

IX. Financial Plan

Revenue and Cost Drivers

[Company Name]’s revenues will come from the sale of candles- both retail and wholesale. The major costs for the company will be staff salaries and supplies. In the initial years, the company’s marketing spend will be high, as it establishes itself in the market.

Capital Requirements and Use of Funds

[Company Name] is currently seeking $270,000 to launch its candle making company. Specifically, these funds will be used as follows:

- Manufacturing equipment and facility setup: $200,000

- Working capital: $70,000 to pay for marketing, salaries, and lease costs until [Company Name] reaches break-even

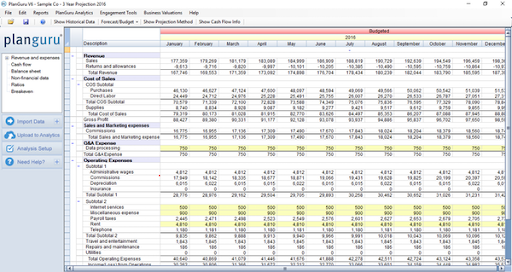

Key Assumptions

The following table reflects the key revenue and cost assumptions made in the financial model:

| Number of ecommerce customers per day | |

|---|---|

| Year 1 | 20 |

| Year 2 | 40 |

| Year 3 | 60 |

| Year 4 | 80 |

| Year 5 | 100 |

| Average number of wholesale accounts | 25 |

| Average order price | $32 |

| Annual increase in order price | 6.00% |

| Annual Lease ( per location) | $25,000 |

| Yearly Lease Increase % | 2.50% |

5 Year Annual Income Statement

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Product/Service A | $151,200 | $333,396 | $367,569 | $405,245 | $446,783 | |

| Product/Service B | $100,800 | $222,264 | $245,046 | $270,163 | $297,855 | |

| Total Revenues | $252,000 | $555,660 | $612,615 | $675,408 | $744,638 | |

| Expenses & Costs | ||||||

| Cost of goods sold | $57,960 | $122,245 | $122,523 | $128,328 | $134,035 | |

| Lease | $60,000 | $61,500 | $63,038 | $64,613 | $66,229 | |

| Marketing | $20,000 | $25,000 | $25,000 | $25,000 | $25,000 | |

| Salaries | $133,890 | $204,030 | $224,943 | $236,190 | $248,000 | |

| Other Expenses | $3,500 | $4,000 | $4,500 | $5,000 | $5,500 | |

| Total Expenses & Costs | $271,850 | $412,775 | $435,504 | $454,131 | $473,263 | |

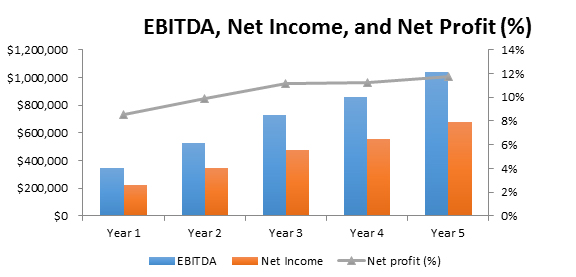

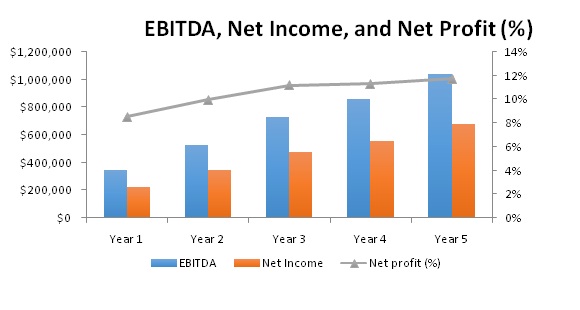

| EBITDA | ($19,850) | $142,885 | $177,112 | $221,277 | $271,374 | |

| Depreciation | $36,960 | $36,960 | $36,960 | $36,960 | $36,960 | |

| EBIT | ($56,810) | $105,925 | $140,152 | $184,317 | $234,414 | |

| Interest | $23,621 | $20,668 | $17,716 | $14,763 | $11,810 | |

| PRETAX INCOME | ($80,431) | $85,257 | $122,436 | $169,554 | $222,604 | |

| Net Operating Loss | ($80,431) | ($80,431) | $0 | $0 | $0 | |

| Income Tax Expense | $0 | $1,689 | $42,853 | $59,344 | $77,911 | |

| NET INCOME | ($80,431) | $83,568 | $79,583 | $110,210 | $144,693 | |

| Net Profit Margin (%) | - | 15.00% | 13.00% | 16.30% | 19.40% |

5 Year Annual Balance Sheet

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $16,710 | $90,188 | $158,957 | $258,570 | $392,389 | |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 | |

| Inventory | $21,000 | $23,153 | $25,526 | $28,142 | $31,027 | |

| Total Current Assets | $37,710 | $113,340 | $184,482 | $286,712 | $423,416 | |

| Fixed assets | $246,450 | $246,450 | $246,450 | $246,450 | $246,450 | |

| Depreciation | $36,960 | $73,920 | $110,880 | $147,840 | $184,800 | |

| Net fixed assets | $209,490 | $172,530 | $135,570 | $98,610 | $61,650 | |

| TOTAL ASSETS | $247,200 | $285,870 | $320,052 | $385,322 | $485,066 | |

| LIABILITIES & EQUITY | ||||||

| Debt | $317,971 | $272,546 | $227,122 | $181,698 | $136,273 | |

| Accounts payable | $9,660 | $10,187 | $10,210 | $10,694 | $11,170 | |

| Total Liabilities | $327,631 | $282,733 | $237,332 | $192,391 | $147,443 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | ($80,431) | $3,137 | $82,720 | $192,930 | $337,623 | |

| Total Equity | ($80,431) | $3,137 | $82,720 | $192,930 | $337,623 | |

| TOTAL LIABILITIES & EQUITY | $247,200 | $285,870 | $320,052 | $385,322 | $485,066 |

5 Year Annual Cash Flow Statement

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | |||||

| Net Income (Loss) | ($80,431) | $83,568 | $79,583 | $110,210 | $144,693 |

| Change in working capital | ($11,340) | ($1,625) | ($2,350) | ($2,133) | ($2,409) |

| Depreciation | $36,960 | $36,960 | $36,960 | $36,960 | $36,960 |

| Net Cash Flow from Operations | ($54,811) | $118,902 | $114,193 | $145,037 | $179,244 |

| CASH FLOW FROM INVESTMENTS | |||||

| Investment | ($246,450) | $0 | $0 | $0 | $0 |

| Net Cash Flow from Investments | ($246,450) | $0 | $0 | $0 | $0 |

| CASH FLOW FROM FINANCING | |||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 |

| Cash from debt | $317,971 | ($45,424) | ($45,424) | ($45,424) | ($45,424) |

| Net Cash Flow from Financing | $317,971 | ($45,424) | ($45,424) | ($45,424) | ($45,424) |

| SUMMARY | |||||

| Net Cash Flow | $16,710 | $73,478 | $68,769 | $99,613 | $133,819 |

| Cash at Beginning of Period | $0 | $16,710 | $90,188 | $158,957 | $258,570 |

| Cash at End of Period | $16,710 | $90,188 | $158,957 | $258,570 | $392,389 |

Microgreens Business Plan Template [Updated 2024]

Microgreens Business Plan Template

If you want to start a Microgreens business or expand your current Microgreens business, you need a business plan.

The following Microgreens business plan template gives you the key elements to include in a winning Microgreens business plan.

Below are links to each of the key sections of a successful microgreens business plan. Once you create your plan, download it to PDF to show banks and investors.

I. Executive Summary

II. Company Overview

III. Industry Analysis

IV. Customer Analysis

V. Competitive Analysis

VI. Marketing Plan

VII. Operations Plan

VIII. Management Team

IX. Financial Plan

Boutique Business Plan Template [Updated 2024]

Boutique Business Plan Template

If you want to start a Boutique business or expand your current Boutique, you need a business plan.

The following Boutique business plan template gives you the key elements to include in a winning Boutique business plan. It can be used to create a business plan for a clothing boutique or an online boutique business plan template.

I. Executive Summary

Business Overview

[Company Name], located at [insert location here] is a new boutique focused on upscale children’s fashions. Our products are fashionable and desired by parents who want to dress their children with the latest trends and designers.

Products and Services

[Company Name]will offer children’s clothing falling into three categories: Infant, Toddler, and Pre-School Age. Featured fashions will change with the season as well as with specific holidays and events (Christmas, Fourth of July, Back to School, etc.). Gift wrapping service will be provided and gift certificates will be sold to encourage customers to buy for the children of friends and family members.

Customer Focus

[Company Name] will primarily serve the residents who live within a 10-mile radius of our boutique. The demographics of these customers are as follows:

- 27,827 residents

- 1,750 workers (who do not live the neighborhood)

- Average income of $54,700

- 38.9% married

- 49.6% in Mgt./Professional occupations

- Median age: 34 years

Management Team

[Company Name]is led by [Founder’s Name] who has been in the retail clothing business for 20 years. While [Founder] has never run a retail boutique himself, he was assistant manager at another boutique previously. As such [Founder] has an in-depth knowledge of the retail clothing business including the operations side (e.g., running day-to-day operations) and the business management side (e.g., staffing, marketing, etc.).

Success Factors

[Company Name] is uniquely qualified to succeed for the following reasons:

- There is currently no high-end children’s boutique in the community we are entering. In addition, we have surveyed the local population and received extremely positive feedback saying that they explicitly want to frequent our business when launched.

- Our location is in a high-volume area with little direct traffic, and will thus be highly convenient to significant numbers of passersby each day.

- The management team has a track record of success in the clothing business.

- The children’s clothing business is a proven business and has succeeded in communities throughout the United States.

Financial Highlights

[Company Name] is currently seeking $330,000 to launch. Specifically, these funds will be used as follows:

- Boutique design/build: $165,000

- Working capital: $165,000 to pay for marketing, salaries, and land costs until [Company Name] reaches break-even.

Top line projections over the next five years are as follows:

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | |

|---|---|---|---|---|---|

| Revenue | $1,080,000 | $2,472,768 | $2,830,825 | $3,240,728 | $3,709,986 |

| Total Expenses | $1,058,015 | $2,087,468 | $2,364,658 | $2,662,118 | $3,006,836 |

| EBITDA | $21,985 | $385,300 | $466,167 | $578,610 | $703,149 |

| Depreciation | $24,840 | $24,840 | $24,840 | $24,840 | $24,840 |

| EBIT | ($2,855) | $360,460 | $441,327 | $553,770 | $678,309 |

| Interest | $21,496 | $18,809 | $16,122 | $13,435 | $10,748 |

| PreTax Income | ($24,351) | $341,652 | $425,205 | $540,336 | $667,562 |

| Income Tax Expense | $0 | $111,055 | $148,822 | $189,118 | $233,647 |

| Net Income | ($24,351) | $230,596 | $276,383 | $351,218 | $433,915 |

| Number of locations | 1 | 1 | 1 | 1 | 1 |

| Average customers/day | 60 | 65 | 70 | 76 | 82 |

| Number of purchases | 10,800 | 23,328 | 25,194 | 27,210 | 29,387 |

II. Company Overview

Company Description

[Company Name]is a new boutique focused on upscale children’s fashions. Our products are fashionable and desired by parents who want to dress their children with the latest trends and designers.

[Company Name] was founded by [Founder’s Name]. While [Founder’s Name] has been in the clothing business for some time, it was in [month, date] that he decided to launch [Company Name]. Specifically, during this time, [Founder] took a trip to Fort Lauderdale, FL. During his trip, [Founder’s Name] frequented an independently-owned children’s boutique that enjoyed tremendous success. After several discussions with the owner of the boutique, [Founder’s Name] clearly understood that a similar business would enjoy significant success in his hometown.

Specifically, the customer demographics and competitive situations in the Fort Lauderdale location and in [insert location here] were so similar that he knew it would work. Furthermore, after surveying the local population, this theory was proven.

[Company Name]’s History

Upon returning from Fort Lauderdale and surveying the local customer base, [Founder’s Name] incorporated [Company Name] as an S-Corporation on [date of incorporation].

[Founder’s Name] has selected three initial locations and is currently undergoing due diligence on each property and the local market to assess which will be the most desirable location for the boutique.

Since incorporation, the company has achieved the following milestones:

- Developed the company’s name, logo and website located at www…

- Determined the list of products to be offered

- Determined equipment and inventory requirements

- Identified 20 potential suppliers and received preliminary interest from them

[Company Name]’s Products

Below is [Company Name]’s initial list of products offered in the store:

- Onesies

- Bodysuits

- Tops (long sleeve and short sleeve)

- Bottoms (pants, skirts, skorts, shorts)

- Sleepwear

- Swimwear

- Accessories

- Shoes

- Sweaters

- Jeans

- Dresses

- Outerwear

The boutique will offer free gift-wrapping service and sell gift certificates in any amount desired. Unworn, unwashed products can be returned for store credit. Transactions will be completed by skilled salespeople on the floor of the boutique, who will offer a high level of customer service and develop ongoing relationships with customers. Delivery of large items will be offered to customers.

Boutique Design

[Company Name] will develop a 5,000 square foot store whose key elements will include the following:

- Main Showroom

- Storage Room

- Check-Out Counter

- Restrooms

- Stroller Locker Area

[Company Name] plans to be open 7 days a week, from 10 AM to 7 PM. As demand dictates, we may extend or reduce our hours.

III. Industry Analysis

Industry Statistics & Market Trends

The following industry size facts and statistics bode well for [Company Name].

According to IBISWorld’s industry report, the U.S. children’s clothing market is estimated at $10.4 billion with just over 13,000 establishments. This translates to roughly $800,000 average revenue per establishment.

The following detail other trends in the market:

- Population growth is set to be strongest among children aged 5 to 9 years, while the 10 to 14 age group looks set to decline.

- Women delaying child bearing until they are older and wealthier, will have a positive impact on premium, branded products leading to retailers offering designer wear for tots.

- Infant and toddler wear continues to claim the lion’s share of this market.

- The proliferation of specialty “baby boutiques” and similar stores that cater to upscale and specialty niches.

IV. Customer Analysis

Demographic Profile of Target Market

[Company Name]will serve the residents of [company location] and the immediately surrounding areas.

The area residents we serve are affluent and are expected spend more on children’s clothing per capita than the national averages.

The precise demographics of the town in which our retail location resides is as follows:

| Wilmette | Winnetka | |

|---|---|---|

| Total Population | 26,097 | 10,725 |

| Square Miles | 6.89 | 3.96 |

| Population Density | 3,789.20 | 2,710.80 |

| Forecasted Population Change by 2017 | -0.02% | -3.76% |

| Population Male | 48.04% | 48.84% |

| Population Female | 51.96% | 51.16% |

| Target Population by Age Group | ||

| Age 18-24 | 3.68% | 3.52% |

| Age 25-34 | 5.22% | 4.50% |

| Age 35-44 | 13.80% | 13.91% |

| Age 45-54 | 18.09% | 18.22% |

| Target Population by Income | ||

| Income $50,000 to $74,999 | 11.16% | 6.00% |

| Income $75,000 to $99,999 | 10.91% | 4.41% |

| Income $100,000 to $124,999 | 9.07% | 6.40% |

| Income $125,000 to $149,999 | 9.95% | 8.02% |

| Income $150,000 to $199,999 | 12.20% | 11.11% |

| Income $200,000 and Over | 32.48% | 54.99% |

Customer Segmentation

We will primarily target the following three customer segments:

- Wealthy Parents: The boutique will attract wealthy parents looking to dress their children fashionably.

- Twenty and Thirty-Somethings: Whether or not they have children themselves, this customer group has friends and siblings who begin to have children and will be purchasing clothes for them as gifts.

- Grandparents: Grandparents will seek out high fashions for their grandchildren at [Company Name].

V. Competitive Analysis

Direct & Indirect Competitors

The following boutiques are located within a 10-mile radius of [Company Name], thus providing either direct or indirect competition for customers:

Joey’s Clothing

Joey’s Clothing is described by their own marketing as “selection that can’t be beat” and has been in business for 32 years. Joey’s offers a wide variety of children’s clothing for ages up to tweens.

Joey’s focuses on national and regional manufacturers that sell a wide variety of products. Joe’s generally has low and medium-priced options for each type of clothing. Joey’s does not sell at least 75% of the high-end products that [Company Name] plans to carry. Joey’s is also located on the outskirts of town and lacks foot traffic to its store.

Macy’s

Macy’s is in the mall in a neighboring town and carries a variety of children’s clothing. With national advertising and high volume of sales overall, due to the many departments within Macy’s, Macy’s is well-known in the community as a source for children’s clothing.

However, Macy’s is not seen as a place to shop for gifts for children as the clothing within are seem as uninteresting and relatively low fashion. The majority of shoppers within the Macy’s children’s department are price-conscious mothers, who shop based on sales and discounts offered. Others dislike Macy’s for the long waits at checkout within the store.

Gymboree

Gymboree carries high-quality children’s clothing and accessories in sizes newborn to age 12. Gymboree opened a location five miles away from [Company location] one year ago. Gymboree has been successful, selling fashionable clothing that is still rugged enough to allow children to play.

[Company Name] has several advantages over Gymboree including:

- Gymboree sells only Gymboree brand clothing, limiting its options

- Gymboree is far from the downtown area where customer foot traffic gives greater visibility

- Gymboree does not offer gift-wrap service within the store

We expect that Gymboree will continue to thrive based on excitement about a recognizable chain among some townspeople. However, we expect that more and more customers will frequent [Company Name] based on the location and the fact that we are independently owned and operated.

Competitive Advantage

[Company Name] enjoys several advantages over its competitors. These advantages include:

- 5 and Under Focus: [Company Name] will focus solely on clothing for children 5 years of age and younger, which is the fastest growing market segment by revenue. By focusing on younger children, we are able to carry a wider variety of high-end brands for these children.

- Management: Our management team has years of children’s clothing retail experience that allows us to sell to and serve customers in a much more sophisticated manner than our competitors.

- Relationships: Having lived in the community for 25 years, [Founder’s Name] knows all of the local leaders and newspapers, as well as clothing suppliers. As such, it will be relatively easy for us to build branding and awareness of our boutique.

VI. Marketing Plan

The Marketing Plan describes the type of brand [Company Name] seeks to create and the Company’s planned promotions and pricing strategies.

The [Company Name] Brand

The [Company Name] brand will focus on the Company’s unique value proposition:

- Offering high-quality, fashionable clothing for children up to age 5

- Rotating clothing to always offer clothing for the proper season geared towards gift-giving

- Providing excellent customer service

Promotions Strategy

[Company Name] expects its target market to be individuals living within a 10-mile radius of its boutique. The Company’s promotions strategy to reach these individuals includes:

Direct Mail

[Company Name] will blanket neighborhoods surrounding its locations with direct mail pieces. These pieces will offer discounts and/or provide other inducements for people to visit the boutique.

Public Relations

We will contact all local and area newspapers and television stations and send them a press release describing the opening and unique value proposition of [Company Name].

Advertising

[Company Name] will initially advertise in local newspapers and sponsor community events in order to gain awareness.

Ongoing Customer Communications

[Company Name] will maintain a website and publish a monthly email newsletter to tell customers about new events, products, and more.

Pre-Opening Events

Before opening the boutique, [Company Name] will organize pre-opening events designed for local merchants and press contacts to create buzz and awareness for [Company Name].

Pricing Strategy

[Company Name] pricing will be appropriate for the high quality and level of service associated with the boutique. Pricing will be on par with Gymboree, and higher (though better quality) than Joey’s and Macy’s.

VII. Operations Plan

Functional Roles

In order to execute on [Company Name]’s business model, the Company needs to perform many functions including the following:

Administrative Functions

- General & administrative functions including legal, marketing, bookkeeping, etc.

- Sourcing suppliers and managing supplier relations

- Hiring and training staff

Retail Functions

- Customer service and check-out

- Gift wrapping

- Gift certificate program management

- Display rotation and design

- Janitor/maintenance personnel to keep the boutique clean

Milestones

[Company Name] expects to achieve the following milestones in the following [] months:

| Date | Milestone |

|---|---|

| [Date 1] | Finalize lease agreement |

| [Date 2] | Design and build out [Company Name]boutique |

| [Date 3] | Hire and train initial staff |

| [Date 4] | Launch [Company Name]boutique |

| [Date 5] | Reach break-even |

VIII. Management Team

Management Team Members

[Company Name]is led by [Founder’s Name] who has been in the retail clothing business for 20 years. While [Founder] has never run a retail boutique himself, he was assistant manager at another boutique previously. As such [Founder] has an in-depth knowledge of the children’s clothing business including:

- Store operations and management

- Floor sales

- Display design

- Retail marketing

- Hiring and training workers

- Children’s clothing fashions and trends

[Founder] has personal relationships with salespeople at a variety of high-end children’s clothing suppliers.

[Founder] graduated from the University of ABC where he majored in Communications.

Hiring Plan

[Founder] will serve as the boutique manager. In order to launch the boutique, we need to hire the following personnel:

- Assistant Manager (Will handle much of boutique operations and manage boutique on [Founder]’s day’s off)

- Check-out and Floor Staff (3 to start)

- Part-Time Bookkeeper (will manage accounts payable, create statements, and execute other administrative functions)

IX. Financial Plan

Revenue and Cost Drivers

[Company Name]’s revenues will come from the sale of children’s clothing to customers.

The major costs for the company will be cost of goods sold (supplier costs), salaries of the staff, and rent for a prime location. In the initial years, the company’s marketing spend will be high, as it establishes itself in the market.

Capital Requirements and Use of Funds

[Company Name is seeking a total funding of $330,000 to launch its boutique. The capital will be used for funding capital expenditures, manpower costs, marketing expenses and working capital.

Specifically, these funds will be used as follows:

- Boutique design/build: approximately $165,000

- Working capital: approximately $165,000 to pay for Marketing, salaries, and lease costs until [Company Name] reaches break-even

Key Assumptions amp; Forecasts

Below please find the key assumptions that went into the financial forecast and a summary of the financial projections over the next five years.

| Number of customers per day | Per location |

|---|---|

| Year 1 | 60 |

| Year 2 | 65 |

| Year 3 | 70 |

| Year 4 | 76 |

| Year 5 | 82 |

| Average order price | $100 |

| Annual increase in order price | 6.00% |

| Annual Lease ( per location) | $100,000 |

| Yearly Lease Increase % | 2.50% |

5 Year Annual Income Statement

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Product/Service A | $151,200 | $333,396 | $367,569 | $405,245 | $446,783 | |

| Product/Service B | $100,800 | $222,264 | $245,046 | $270,163 | $297,855 | |

| Total Revenues | $252,000 | $555,660 | $612,615 | $675,408 | $744,638 | |

| Expenses & Costs | ||||||

| Cost of goods sold | $57,960 | $122,245 | $122,523 | $128,328 | $134,035 | |

| Lease | $60,000 | $61,500 | $63,038 | $64,613 | $66,229 | |

| Marketing | $20,000 | $25,000 | $25,000 | $25,000 | $25,000 | |

| Salaries | $133,890 | $204,030 | $224,943 | $236,190 | $248,000 | |

| Other Expenses | $3,500 | $4,000 | $4,500 | $5,000 | $5,500 | |

| Total Expenses & Costs | $271,850 | $412,775 | $435,504 | $454,131 | $473,263 | |

| EBITDA | ($19,850) | $142,885 | $177,112 | $221,277 | $271,374 | |

| Depreciation | $36,960 | $36,960 | $36,960 | $36,960 | $36,960 | |

| EBIT | ($56,810) | $105,925 | $140,152 | $184,317 | $234,414 | |

| Interest | $23,621 | $20,668 | $17,716 | $14,763 | $11,810 | |

| PRETAX INCOME | ($80,431) | $85,257 | $122,436 | $169,554 | $222,604 | |

| Net Operating Loss | ($80,431) | ($80,431) | $0 | $0 | $0 | |

| Income Tax Expense | $0 | $1,689 | $42,853 | $59,344 | $77,911 | |

| NET INCOME | ($80,431) | $83,568 | $79,583 | $110,210 | $144,693 | |

| Net Profit Margin (%) | - | 15.00% | 13.00% | 16.30% | 19.40% |

5 Year Annual Balance Sheet

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $16,710 | $90,188 | $158,957 | $258,570 | $392,389 | |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 | |

| Inventory | $21,000 | $23,153 | $25,526 | $28,142 | $31,027 | |

| Total Current Assets | $37,710 | $113,340 | $184,482 | $286,712 | $423,416 | |

| Fixed assets | $246,450 | $246,450 | $246,450 | $246,450 | $246,450 | |

| Depreciation | $36,960 | $73,920 | $110,880 | $147,840 | $184,800 | |

| Net fixed assets | $209,490 | $172,530 | $135,570 | $98,610 | $61,650 | |

| TOTAL ASSETS | $247,200 | $285,870 | $320,052 | $385,322 | $485,066 | |

| LIABILITIES & EQUITY | ||||||

| Debt | $317,971 | $272,546 | $227,122 | $181,698 | $136,273 | |

| Accounts payable | $9,660 | $10,187 | $10,210 | $10,694 | $11,170 | |

| Total Liabilities | $327,631 | $282,733 | $237,332 | $192,391 | $147,443 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | ($80,431) | $3,137 | $82,720 | $192,930 | $337,623 | |

| Total Equity | ($80,431) | $3,137 | $82,720 | $192,930 | $337,623 | |

| TOTAL LIABILITIES & EQUITY | $247,200 | $285,870 | $320,052 | $385,322 | $485,066 |

5 Year Annual Cash Flow Statement

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | |||||

| Net Income (Loss) | ($80,431) | $83,568 | $79,583 | $110,210 | $144,693 |

| Change in working capital | ($11,340) | ($1,625) | ($2,350) | ($2,133) | ($2,409) |

| Depreciation | $36,960 | $36,960 | $36,960 | $36,960 | $36,960 |

| Net Cash Flow from Operations | ($54,811) | $118,902 | $114,193 | $145,037 | $179,244 |

| CASH FLOW FROM INVESTMENTS | |||||

| Investment | ($246,450) | $0 | $0 | $0 | $0 |

| Net Cash Flow from Investments | ($246,450) | $0 | $0 | $0 | $0 |

| CASH FLOW FROM FINANCING | |||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 |

| Cash from debt | $317,971 | ($45,424) | ($45,424) | ($45,424) | ($45,424) |

| Net Cash Flow from Financing | $317,971 | ($45,424) | ($45,424) | ($45,424) | ($45,424) |

| SUMMARY | |||||

| Net Cash Flow | $16,710 | $73,478 | $68,769 | $99,613 | $133,819 |

| Cash at Beginning of Period | $0 | $16,710 | $90,188 | $158,957 | $258,570 |

| Cash at End of Period | $16,710 | $90,188 | $158,957 | $258,570 | $392,389 |

Plant Nursery Business Plan Template [Updated 2024]

Plant Nursery Business Plan Template

If you want to start a Plant Nursery business or expand your current Plant Nursery business, you need a business plan.

The following Plant Nursery business plan template gives you the key elements to include in a winning Plant Nursery business plan.

Below are links to each of the key sections of your Plant Nursery business plan:

I. Executive Summary

II. Company Overview

III. Industry Analysis

IV. Customer Analysis

V. Competitive Analysis

VI. Marketing Plan

VII. Operations Plan

VIII. Management Team

IX. Financial Plan

Jewelry Business Plan Template [Updated 2024]

Jewelry Business Plan Template

If you want to start a Jewelry business or expand your current Jewelry, you need a business plan.

The following Jewelry business plan template gives you the key elements to include in a winning Jewelry business plan.

Below are links to each of the key sections of your Jewelry business plan:

Jewelry Business Plan Home

I. Executive Summary

II. Company Overview

III. Industry Analysis

IV. Customer Analysis

V. Competitive Analysis

VI. Marketing Plan

VII. Operations Plan

VIII. Management Team

IX. Financial Plan

Physical Therapy Business Plan Template [Updated 2024]

Physical Therapy Business Plan Template

If you want to start a Physical Therapy business or expand your current Physical Therapy business, you need a business plan.

The following Physical Therapy business plan template gives you the key elements to include in a winning Physical Therapy business plan.

Below are links to each of the key sections of your Physical Therapy business plan:

I. Executive Summary

II. Company Overview

III. Industry Analysis

IV. Customer Analysis

V. Competitive Analysis

VI. Marketing Plan

VII. Operations Plan

VIII. Management Team

IX. Financial Plan

Non Medical Home Care Business Plan Template [Updated 2024]

Non Medical Home Care Business Plan Template

If you want to start a successful non medical home care business or expand your current non medical home care business, you need a business plan.

Fortunately, you’re in the right place. Our team has helped develop over 100,000 business plans over the past 20 years, including thousands of non-medical home care business plans.

The following non medical home care business plan template and example gives you the key elements you must include in your plan. In our experience speaking with lenders and investors, the template is organized in the precise format they want.

Non Medical Home Care Business Plan Example

I. Executive Summary

Business Overview

[Company Name] is a new non-medical home care business that serves the residents of [Location]. Our caregivers are fully licensed and trained to provide aging residents with essential day-to-day care that does not require medical assistance. Some of our services include preparing meals, cleaning, dressing and washing our customers, or running their errands. As individuals get older, it gets much harder to do these things without extra help. However, living in a nursing home is not an option for many people. Therefore, our caregivers can help these individuals with these tasks without them leaving their homes or losing their independence.

Services Offered

[Company Name] will provide essential non-medical care and day-to-day assistance. Our licensed practitioners can help with basic care tasks, chores, and errands, or even just provide companionship. Below are some example tasks that our practitioners can help with:

- Cooking food

- Driving to appointments

- Cleaning

- Dressing and washing

- Playing board games

Customer Focus

[Company Name] will serve the aging community of [Location]. The demographics of this area are as follows:

- 103,169 residents

- Average income of $65,000

- 57.4% married

- 38.2% retired and/or over the age of 55

- Median age: 42 years

Management Team

[Company Name] is owned and operated by [Founder’s Name], a nurse who has worked at local assisted care facilities for over ten years. Throughout her career, she noticed that many of her patients didn’t need extensive medical care or supervision and would have been better suited to having a care professional at home. However, there are few companies in [Location] that provide non-medical home care services for this demographic. Therefore, [Founder’s Name] aims to provide the best in-home non-medical care that helps elderly individuals maintain their quality of life without moving out of their homes.

Success Factors

[Company Name] is uniquely qualified to succeed due to the following reasons:

- [Company Name] will have a team of compassionate and knowledgeable staff that are experienced in this field. This staff includes nurses, home aides, and other general administrative staff.

- [Company Name] will be able to service the entire metropolitan area of [Location] and its surrounding areas.

- There is a great demand for non-medical home care services, as many local residents do not want to live in an assisted care facility just to get help with basic tasks.

- The non-medical home care business has proven to be a successful business in the United States.

Financial Highlights

[Company Name] is seeking $150,000 in funding to launch its non-medical home care business. The capital will be used for funding capital expenditures, staffing, marketing and advertising expenses, and working capital.

The breakout of the funding may be seen below:

- Capital expenditures (computers, equipment, etc.): $20,000

- Marketing and advertising: $30,000

- Staffing costs: $80,000

- Working capital: $20,000

Top line projections over the next five years are as follows:

| Financial Summary | FY 1 | FY 2 | FY 3 | FY 4 | FY 5 |

|---|---|---|---|---|---|

| Revenue | $560,401 | $782,152 | $1,069,331 | $1,379,434 | $1,699,644 |

| Total Expenses | $328,233 | $391,429 | $552,149 | $696,577 | $776,687 |

| EBITDA | $232,168 | $390,722 | $517,182 | $682,858 | $922,956 |

| Depreciation | $7,000 | $7,000 | $7,000 | $7,000 | $7,000 |

| EBIT | $225,168 | $383,722 | $510,182 | $675,858 | $915,956 |

| Interest | $6,016 | $5,264 | $4,512 | $3,760 | $3,008 |

| Pre Tax Income | $219,152 | $378,458 | $505,670 | $672,098 | $912,948 |

| Income Tax Expense | $76,703 | $132,460 | $176,985 | $235,234 | $319,532 |

| Net Income | $142,449 | $245,998 | $328,686 | $436,864 | $593,416 |

| Net Profit Margin | 25% | 31% | 31% | 32% | 35% |

II. Company Overview

Who is [Company Name]?

[Company Name] is a new non-medical home care business that serves the residents of [Location]. Our caregivers are fully licensed and trained to provide aging residents with essential day-to-day care that does not require medical assistance. Some of our services include preparing meals, cleaning, dressing and washing our customers, or running their errands. As individuals get older, it gets much harder to do these things without extra help. However, living in a nursing home is not an option for many people. Therefore, our caregivers can help these individuals with these tasks without them leaving their homes or losing their independence.

[Company Name]’s History

[Founder’s Name] has worked with thousands of elderly patients during her career as a nurse. She often found that many people did not need to live in an assisted care facility when they only needed help with basic day-to-day tasks. Instead, she found that these patients often enjoyed a higher quality of life when they received care from their homes. This revelation inspired her to start a business where she and other professionals could provide non-medical care to local elderly patients in the comfort of their homes. After conducting the research needed to establish the company, [Founder’s Name] incorporated [Company Name] as an S-corporation on [date of incorporation].

Since incorporation, [Company Name] has achieved the following milestones:

- Found an office location and signed a Letter of Intent to lease it

- Developed the logo and website for the company

- Finalized list of services the company will be able to provide

- Determined the office equipment and inventory requirements

- Began recruiting key employees

[Company Name]’s Products/Services

[Company Name] will provide essential non-medical care and day-to-day assistance. Our licensed practitioners can help with basic care tasks, chores, and errands, or even just provide companionship. Below are some example tasks that our practitioners can help with:

- Cooking food

- Driving to appointments

- Cleaning

- Dressing and washing

- Playing board games

III. Industry Analysis

You can download our Business Plan Template (including a full, customizable financial model) to your computer here.

According to IBIS World, the global home care industry was valued at $136 billion USD and is expected to grow 4.8% in 2023 alone. The past five years saw a nearly 10% compound annual growth rate for the industry and there is no indication that this growth will slow down anytime soon. This shows that home care services will be in great demand, which means it is a great time to start a non-medical home care business.

This growth is primarily driven by a quickly aging population. People are living longer than ever before and they will need comfortable medical and non-medical care services for much longer. Furthermore, baby boomers comprise a large population and are now entering their retirement years. It is expected that this enormous population will have a significant need for both healthcare and non-medical care and may create a strain on the current industry. However, this also means there is an enormous opportunity for these industries to be extremely profitable in the near future.

This is especially true for home care services, which are increasing in demand. Most aging people would rather receive medical or non-medical care at home than go to a nursing home or hospital. Therefore, there is an incredible demand for these particular services.

The only challenge affecting the industry is a lack of properly trained staff. However, this will only mean that home care services and their staff will be even more valued. These industry trends will ensure the popularity and success of [Company Name] in the near future.

IV. Customer Analysis

Demographic Profile of Target Market

[Company Name] will serve the community residents of [Location] and its surrounding areas.

The community of [Location] has thousands of retired, elderly adults who require a greater need of attention. Many of the aging community would prefer to receive their non-medical care in the comfort of their own home rather than in an assisted living facility.

A demographic profile of this market is as follows:

| Wilmette | Winnetka | |

|---|---|---|

| Total Population | 26,097 | 10,725 |

| Square Miles | 6.89 | 3.96 |

| Population Density | 3,789.20 | 2,710.80 |

| Population Male | 48.04% | 48.84% |

| Population Female | 51.96% | 51.16% |

| Target Population by Age Group | ||

| Age 18-24 | 3.68% | 3.52% |

| Age 25-34 | 5.22% | 4.50% |

| Age 35-44 | 13.80% | 13.91% |

| Age 45-54 | 18.09% | 18.22% |

| Target Population by Income | ||

| Income $50,000 to $74,999 | 11.16% | 6.00% |

| Income $75,000 to $99,999 | 10.91% | 4.41% |

| Income $100,000 to $124,999 | 9.07% | 6.40% |

| Income $125,000 to $149,999 | 9.95% | 8.02% |

| Income $150,000 to $199,999 | 12.20% | 11.11% |

| Income $200,000 and Over | 32.48% | 54.99% |

Customer Segmentation

We will primarily target the following customer segments:

- Elderly individuals: We will primarily market to elderly individuals who are struggling to complete basic tasks but don’t want to move to a nursing home or assisted care facility.

- Families of elderly individuals: Sometimes our customers don’t realize how much they are struggling or that they need some extra care. However, this is usually evident to their family members. Therefore, we will also market to families with aging relatives.

V. Competitive Analysis

Direct & Indirect Competitors

The following companies are located within a 20-mile radius of [Company Name], thus providing either direct or indirect competition for customers:

Washington County Home Care

Washington County Home Care has provided both medical and non-medical home care services for over a decade. Their staff is composed of dedicated professionals who are committed to providing quality care in the comfort and convenience of the patients’ homes. Registered nurses, licensed practical nurses, nutritionists, speech therapists, physical therapists, occupational therapists, and medical social workers all work with the patient and their family to develop an individual plan of treatment. In addition to medical care, Washington County Home Care also has a team of home care aides who provide non-medical services as well.

Elara Caring

Elara Caring is one of the nation’s largest providers of home-based care, with a footprint in the Northeast, Midwest, and South. Elara Caring brings together three award-winning organizations – Great Lakes Caring, National Home Health Care, and Jordan Health Services, into one transformational company. They provide the highest-quality comprehensive care continuum of personal care, skilled home health, hospice care, and behavioral health. Their intimate understanding of their patients’ needs allows them to apply proprietary platforms to deliver proactive, customized care that improves the quality of life and keeps patients in their homes.

Encompass Health

Serving the [Location] area, they are one of the nation’s leading providers of home health services and continually set the standard of homecare through their people, their approach, and their outcomes.

The patient experience is at the core of everything they do. That’s why they work collaboratively with the patient’s team of experts to craft a plan of care that meets their specific needs. Their skilled nurses, physical therapists, occupational therapists, speech-language pathologists, medical social workers, and home health aides use a coordinated, interprofessional approach to deliver compassionate, specialized care in the comfort of home.

Whether recovering from surgery, a recent hospital stay, or managing a disease or injury, Encompass Health’s services are designed to meet patients where they are. They offer cutting-edge specialty programs that focus on patient education, self-management, and reducing hospital readmission, resulting in better care and better outcomes for their patients.

Competitive Advantage

[Company Name] has several advantages over its competition. Those advantages include:

- Compassionate Staff: Knowledgeable and friendly staff of home aids and nurses who are highly knowledgeable and experienced in their field.

- Location: [Company Name] will be able to service the entire metropolitan area of [Location] and its surrounding areas.

- Quality Care: [Company Name] will provide expert services so that the patients are at the highest comfort level.

- Pricing: [Company Name]’s pricing will be more affordable than its competition. We will also provide payment plans and flexible payment policies so that the patient won’t have to sacrifice any type of care they might require because the cost is too high.

VI. Marketing Plan

The [Company Name] Brand

The [Company Name] brand will focus on the Company’s unique value proposition:

- Knowledgeable, friendly, expert staff of home care professionals.

- Quality level of service and care.

- Offering the best non-medical home care at competitive prices.

Promotions Strategy

[Company Name] will target all residents of [Location] within a 20-30 mile radius. The company’s promotions strategy to reach the most clientele include:

Local Hospitals

[Founder’s Name] already has great relationships with the local hospitals. She will work to make sure the hospitals send referrals and highly recommend [Company Name] to its patients and their families upon releasing them from the hospital.

Nursing Homes and Assisted Living Facilities

Oftentimes, an elderly patient will be placed in a nursing home or assisted living facility right away. Sometimes they are not happy and would rather go back home. [Company Name] will work with these facilities so that they recommend their agency when a patient highly desires to receive care in the comfort of their own home.

Website

[Company Name] will have an informative and attractive website that will feature all of its services and referrals from other satisfied patients. The website will be highly informative and be designed in a way that is friendly and eye-catching.

SEO

[Company Name] will invest in a high SEO presence so that the agency is listed at the top of the Google or Bing search engine when a family member is researching home care agencies in [Location].

Billboard

[Company Name] will have a billboard in an area of town at a busy intersection where thousands of cars and pedestrians pass daily. The location of the billboard will be in an area of town where there are a lot of assisted care facilities, doctors’ offices, rehab facilities, and a hospital nearby.

Advertising

[Company Name] will invest in advertisements in featured local publications, such as community newspapers and newsletters that focus on the retired and aging population.

Pricing Strategy

[Company Name]’s pricing will be moderate so customers feel they receive great value when purchasing its services.

VII. Operations Plan

Functional Roles

[Company Name] will need to fulfill the following functional roles in order to execute its business plan and ensure the company’s success:

Administrative Functions

- Marketing functions

- Bookkeeping functions

- Hiring and training staff

- Website and social media management

Care Functions

- Drive customers to errands and appointments

- Help with cooking and cleaning

- Dress and wash customers

- Provide companionship

Milestones

The following are a series of steps that lead to our vision of long-term success. [Company Name] expects to achieve the following milestones in the following [xyz] months:

| Date | Milestone |

|---|---|

| [Date 1] | Finalize lease agreement |

| [Date 2] | Design and build out [Company Name] |

| [Date 3] | Hire and train initial staff |

| [Date 4] | Kickoff of promotional campaign |

| [Date 5] | Launch [Company Name] |

| [Date 6] | Reach break-even |

VIII. Management Team

Management Team Members

[Company Name] is owned and operated by [Founder’s Name], a nurse who has worked at local assisted care facilities for over ten years. Throughout her career, she noticed that many of her patients didn’t need extensive medical care or supervision and would have been better suited to having a care professional at home. However, there are few companies in [Location] that provide non-medical home care services for this demographic. Therefore, [Founder’s Name] aims to provide the best in-home non-medical care that helps elderly individuals maintain their quality of life without moving out of their homes.

Hiring Plan

[Founder’s Name] will serve as the company’s Founder and Chief Executive Officer. She will hire the following personnel in order to maintain an effective and profitable non-medical home care business:

- Administrative Assistant (2 to start)

- Office Manager (1 to start)

- Home Care Aides (3 to start)

IX. Financial Plan

Revenue and Cost Drivers

The revenues for [Company Name] will come from the fees it will charge for its services.

The cost drivers for the company will be the payroll of the staff, lease on the office building, office supplies and equipment, and marketing and advertising costs.

Capital Requirements and Use of Funds

[Company Name] is seeking $150,000 in funding to launch its non-medical home care business. The capital will be used for funding capital expenditures, staffing, marketing and advertising expenses, and working capital.

The breakout of the funding may be seen below:

- Capital expenditures (computers, equipment, etc.): $20,000

- Marketing and advertising: $30,000

- Staffing costs: $80,000

- Working capital: $20,000

Key Assumptions

The following table reflects the key revenue and cost assumptions made in the financial model:

| Number of Clients | Average |

|---|---|

| FY 1 | 120 |

| FY 2 | 150 |

| FY 3 | 180 |

| FY 4 | 200 |

| FY 5 | 220 |

5 Year Annual Income Statement

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Product/Service A | $151,200 | $333,396 | $367,569 | $405,245 | $446,783 | |

| Product/Service B | $100,800 | $222,264 | $245,046 | $270,163 | $297,855 | |

| Total Revenues | $252,000 | $555,660 | $612,615 | $675,408 | $744,638 | |

| Expenses & Costs | ||||||

| Cost of goods sold | $57,960 | $122,245 | $122,523 | $128,328 | $134,035 | |

| Lease | $60,000 | $61,500 | $63,038 | $64,613 | $66,229 | |

| Marketing | $20,000 | $25,000 | $25,000 | $25,000 | $25,000 | |

| Salaries | $133,890 | $204,030 | $224,943 | $236,190 | $248,000 | |

| Other Expenses | $3,500 | $4,000 | $4,500 | $5,000 | $5,500 | |

| Total Expenses & Costs | $271,850 | $412,775 | $435,504 | $454,131 | $473,263 | |

| EBITDA | ($19,850) | $142,885 | $177,112 | $221,277 | $271,374 | |

| Depreciation | $36,960 | $36,960 | $36,960 | $36,960 | $36,960 | |

| EBIT | ($56,810) | $105,925 | $140,152 | $184,317 | $234,414 | |

| Interest | $23,621 | $20,668 | $17,716 | $14,763 | $11,810 | |

| PRETAX INCOME | ($80,431) | $85,257 | $122,436 | $169,554 | $222,604 | |

| Net Operating Loss | ($80,431) | ($80,431) | $0 | $0 | $0 | |

| Income Tax Expense | $0 | $1,689 | $42,853 | $59,344 | $77,911 | |

| NET INCOME | ($80,431) | $83,568 | $79,583 | $110,210 | $144,693 | |

| Net Profit Margin (%) | - | 15.00% | 13.00% | 16.30% | 19.40% |

5 Year Annual Balance Sheet

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $16,710 | $90,188 | $158,957 | $258,570 | $392,389 | |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 | |

| Inventory | $21,000 | $23,153 | $25,526 | $28,142 | $31,027 | |

| Total Current Assets | $37,710 | $113,340 | $184,482 | $286,712 | $423,416 | |

| Fixed assets | $246,450 | $246,450 | $246,450 | $246,450 | $246,450 | |

| Depreciation | $36,960 | $73,920 | $110,880 | $147,840 | $184,800 | |

| Net fixed assets | $209,490 | $172,530 | $135,570 | $98,610 | $61,650 | |

| TOTAL ASSETS | $247,200 | $285,870 | $320,052 | $385,322 | $485,066 | |

| LIABILITIES & EQUITY | ||||||

| Debt | $317,971 | $272,546 | $227,122 | $181,698 | $136,273 | |

| Accounts payable | $9,660 | $10,187 | $10,210 | $10,694 | $11,170 | |

| Total Liabilities | $327,631 | $282,733 | $237,332 | $192,391 | $147,443 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | ($80,431) | $3,137 | $82,720 | $192,930 | $337,623 | |

| Total Equity | ($80,431) | $3,137 | $82,720 | $192,930 | $337,623 | |

| TOTAL LIABILITIES & EQUITY | $247,200 | $285,870 | $320,052 | $385,322 | $485,066 |

5 Year Annual Cash Flow Statement

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | |||||

| Net Income (Loss) | ($80,431) | $83,568 | $79,583 | $110,210 | $144,693 |

| Change in working capital | ($11,340) | ($1,625) | ($2,350) | ($2,133) | ($2,409) |

| Depreciation | $36,960 | $36,960 | $36,960 | $36,960 | $36,960 |

| Net Cash Flow from Operations | ($54,811) | $118,902 | $114,193 | $145,037 | $179,244 |

| CASH FLOW FROM INVESTMENTS | |||||

| Investment | ($246,450) | $0 | $0 | $0 | $0 |

| Net Cash Flow from Investments | ($246,450) | $0 | $0 | $0 | $0 |

| CASH FLOW FROM FINANCING | |||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 |

| Cash from debt | $317,971 | ($45,424) | ($45,424) | ($45,424) | ($45,424) |

| Net Cash Flow from Financing | $317,971 | ($45,424) | ($45,424) | ($45,424) | ($45,424) |

| SUMMARY | |||||

| Net Cash Flow | $16,710 | $73,478 | $68,769 | $99,613 | $133,819 |

| Cash at Beginning of Period | $0 | $16,710 | $90,188 | $158,957 | $258,570 |

| Cash at End of Period | $16,710 | $90,188 | $158,957 | $258,570 | $392,389 |

Interior Design Business Plan Template [Updated 2024]

Interior Design Business Plan Template

If you want to start an Interior Design business or expand your current Interior Design business, you need a business plan.

The following Interior Design business plan template gives you the key elements to include in a winning Interior Design business plan.

Below are links to each of the key sections of an example interior design business plan. Once you create your plan, download it to PDF to show banks and investors.

Interior Design Business Plan Home

I. Executive Summary

II. Company Overview

III. Industry Analysis

IV. Customer Analysis

V. Competitive Analysis

VI. Marketing Plan

VII. Operations Plan

VIII. Management Team

IX. Financial Plan

Chiropractic Business Plan Template [Updated 2024]

Chiropractic Business Plan Template

If you want to start a Chiropractic business or expand your current Chiropractic business, you need a business plan.

The following Chiropractic business plan template gives you the key elements to include in a winning Chiropractic business plan.

Below are links to each of the key sections of your Chiropractic business plan:

Chiropractic Business Plan Home

I. Executive Summary

II. Company Overview

III. Industry Analysis

IV. Customer Analysis

V. Competitive Analysis

VI. Marketing Plan

VII. Operations Plan

VIII. Management Team

IX. Financial Plan

Handyman Business Plan Template [Updated 2024]

Handyman Business Plan Template

If you want to start a handyman business or expand your current handyman company, you need a business plan.

The following business plan template gives you the key elements to include in a winning Handyman business plan.

Example Business Plan For Handyman Businesses

Below are links to each of the key sections of a sample business plan for a successful handyman services business.

I. Executive Summary– The Executive Summary provides an overview of your new handyman business, unique value proposition, key objectives and business goals. It also summarizes all sections of your business plan.

II. Company Overview– The company analysis includes information about your business concept, handyman services and legal structure.

III. Industry Analysis– The industry analysis includes market research that supports your business and provides insights into market trends and the handyman industry.

IV. Customer Analysis– The market analysis provides an overview of your target market and customer segments.

V. Competitive Analysis– The competitive analysis should identify your direct and indirect competitors and highlight your competitive advantage.

VI. Marketing Plan– The marketing plan includes your marketing strategy, sales strategy, pricing strategy and search engine optimization plan.

VII. Operations Plan– The Operations Plan includes information on your company’s day to day operations and processes.

VIII. Management Team– The management team section includes a profile of the business owner and business management, their experience and company responsibilities.

IX. Financial Plan– The financial plan includes financial projections, a cash flow statement, profit and loss statement and balance sheet.

Funeral Home Business Plan Template [Updated 2024]

Funeral Home Business Plan Template

If you want to start a Funeral Home or expand your current Funeral Home business, you need a business plan.

The following Funeral Home business plan template gives you the key elements for starting a funeral home business plan.

Below are links to each of the key sections of your Funeral Home business plan:

Funeral Home Business Plan Home

I. Executive Summary

II. Company Overview

III. Industry Analysis

IV. Customer Analysis

V. Competitive Analysis

VI. Marketing Plan

VII. Operations Plan

VIII. Management Team

IX. Financial Plan

Urgent Care Business Plan Template [Updated 2024]

Urgent Care Business Plan Template

If you want to start an Urgent Care business or expand your current Urgent Care center, you need a business plan.

The following Urgent Care business plan template gives you the key elements to include in a winning Urgent Care business plan.

Below are links to each of the key sections of your Urgent Care business plan:

I. Executive Summary

II. Company Overview

III. Industry Analysis

IV. Customer Analysis

V. Competitive Analysis

VI. Marketing Plan

VII. Operations Plan

VIII. Management Team

IX. Financial Plan

Poultry Farm Business Plan Template [Updated 2024]

Poultry Farm Business Plan Template

If you want to start a Poultry Farm or expand your current Poultry Farm, you need a business plan.

The following Poultry Farm business plan template gives you the key elements to include in a winning Poultry Farm business plan.

Below are links to each of the key sections of your Poultry Farm business plan:

Poultry Farm Business Plan Home

I. Executive Summary

II. Company Overview

III. Industry Analysis

IV. Customer Analysis

V. Competitive Analysis

VI. Marketing Plan

VII. Operations Plan

VIII. Management Team

IX. Financial Plan

Event Planning Business Plan Template [Updated 2024]

Event Planning Business Plan Template

If you want to start an Event Planning business or expand your current Event Planning or Event Management business, you need a business plan.

The following Event Planning business plan template gives you the key elements to include in a winning event planner business plan or event management business plan.

Below are links to each of the key sections of a free Event Planning business plan template:

Event Business Plan Template

I. Executive Summary

II. Company Overview

III. Industry Analysis

IV. Customer Analysis

V. Competitive Analysis

VI. Marketing Plan

VII. Operations Plan

VIII. Management Team

IX. Financial Plan

Hotshot Trucking Business Plan Template [Updated 2024]

Hotshot Trucking Business Plan Template

If you want to start a Hotshot Trucking business or expand your current Hotshot Trucking business, you need a business plan.

The following Hotshot Trucking business plan template gives you the key elements to include in a winning Hotshot Trucking business plan.

Below are links to each of the key sections of an example hotshot trucking business plan. Once you create your plan, download it to PDF to show banks and investors.

I. Executive Summary

II. Company Overview

III. Industry Analysis

IV. Customer Analysis

V. Competitive Analysis

VI. Marketing Plan

VII. Operations Plan

VIII. Management Team

IX. Financial Plan

Non-Emergency Medical Transportation Business Plan [Updated 2024]

Non-Emergency Medical Transportation Business Plan Template

If you want to start a Non-Emergency Medical Transportation business or expand your current NEMT business, you need a business plan.

The following Non-Emergency Medical Transportation business plan template gives you the key elements to include in a winning NEMT business plan.

Below are links to each of the key sections of an example non emergency medical transportation business plan. Once you create your plan, download it to PDF to show banks and investors.

I. Executive Summary

II. Company Overview

III. Industry Analysis

IV. Customer Analysis

V. Competitive Analysis

VI. Marketing Plan

VII. Operations Plan

VIII. Management Team

IX. Financial Plan

Art Gallery Business Plan Template [Updated 2024]

Art Gallery Business Plan Template

If you want to start an art gallery or expand your current art gallery, you need a business plan.

The following art gallery business plan template gives you the key elements to include in a winning art gallery business plan.

Below are links to each of the key sections of an example art gallery business plan. Once you create your plan, download it to PDF to show banks and investors.

Art Gallery Business Plan Home

I. Executive Summary

II. Company Overview

III. Industry Analysis

IV. Customer Analysis

V. Competitive Analysis

VI. Marketing Plan

VII. Operations Plan

VIII. Management Team

IX. Financial Plan

HVAC Business Plan Template [Updated 2024]

HVAC Business Plan Template

If you want to start a HVAC business or expand your current HVAC company, you need a business plan.

Fortunately, you’re in the right place. Our team has helped develop over 100,000 business plans over the past 20 years, including thousands of HVAC business plans.

The following HVAC business plan template and example gives you the key elements you must include in your plan. In our experience speaking with lenders and investors, the template is organized in the precise format they want.

Example Business Plan For HVAC Businesses

I. Executive Summary

Business Overview

[Company Name] is a new residential HVAC company located in [location]. We will provide numerous services to ensure the residents of [location] remain comfortable in their homes. Some of these services include the repair and installation of furnaces, air conditioning systems, and hot water tanks. Customers can expect speedy and high-quality work paired with friendliness and excellent customer service.

Services

[Company Name] provides numerous services that help to keep the homes of [location] comfortable. These services include the installation and repair of the following:

- Air conditioning systems

- Furnaces